How Construction Reality Mapping Reduces Risk for Insurance Stakeholders

Now more than ever, construction companies, risk engineers, and insurance stakeholders are using reality mapping and digital twin technology to evaluate and mitigate risk on the job site. In this article, we will zero in on how this technology is changing the way stakeholders analyze, manage, and mitigate risk throughout the project life cycle — and even once construction is complete.

Here is an overview of some of the different insurance-related risk factors that cutting-edge photogrammetry technology can help reduce:

1. Design defect risk

A design defect is a specific component or module that has been fabricated or manufactured properly but is still defective because of how it was designed. As a result, the component is considered hazardous, either during construction or once operations begin.

Often, design defects are the basis for a product liability or defective product lawsuit — especially if the defect results in an injury, particularly during construction or operation. In a product liability case, for example, a plaintiff can establish the existence of a design defect by showing an alternate design as purposeful, practical, and economically feasible as the original design.

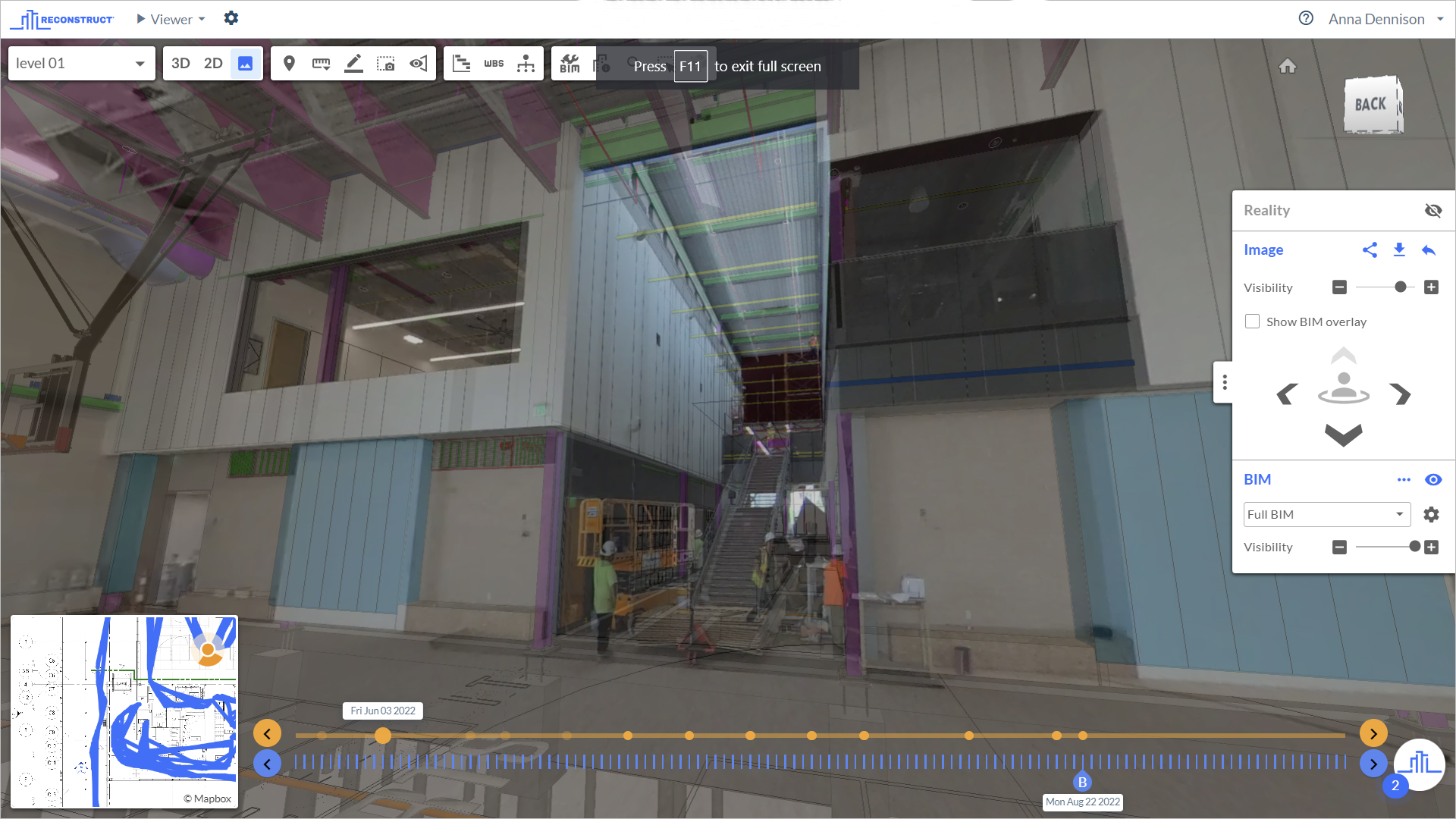

To combat this risk, Reconstruct’s 2D and 3D design integration tools allow stakeholders to overlay all types of designs and drawings atop the reconstructed digital twin of the job site. This allows users to immediately compare what has been built against what has been planned and, most importantly, review the design of a certain product or module in the context of the entire facility.

The more frequently reality capture is performed, the more up-to-date the digital twin is — and the more expediently stakeholders can identify potential or actual design defects. This can help manage risk regarding product liability or defective product issues.

2. Faulty workmanship

Another significant risk factor is when the work performed on-site does not conform to the requirement of any inspection, test, or approval as the basis of design. Yet again, Reconstruct’s 2D and 3D design integration tools allow stakeholders to overlay all types of designs and drawings atop the reconstructed digital twin of the job site. This allows users to:

- Immediately perform inspection and test on the as-built conditions using measurable reality data.

- Identify potential or actual cases of unsafe or unsuitable installations and, in turn, prevent defective workmanship or related lawsuits down the road.

Related: What Challenges Do Digital Twins Solve in Construction, Inspection, and Engineering?

3. Payment issues for contractors and subcontractors

Another chief risk throughout construction is unbalanced payments or delayed payments to contractors and subcontractors, which, unfortunately, may result in a default of performance, including both direct and indirect costs. To help improve the overall cost of risk, stakeholders are constantly looking into ways by which actual work completed on sites has been proactively reviewed for progress and quality. This can help prevent issues from surfacing on their project sites down the line.

Because Reconstruct creates a true Time Machine for Construction™ that can be integrated with project schedule, stakeholders can track the progress of subcontractors and the job at large without constant travel to the job site — and without relying on the first-hand reports of those subcontractors.

Instead, all stakeholders and parties review the same single source of project truth to get clear-cut answers about what work has been done, when, and by whom. This makes payment applications more accurate and expedites them, too.

This is especially helpful regarding surety bonds and subcontractor default insurance (SDI).

4. Worker injuries and casualties

The safety of all humans on the job site is always the first and foremost priority of all stakeholders. Because Reconstruct offers a virtual and remote walk-through of the job site's current conditions, offsite stakeholders (including insurers) can constantly check on a project's adherence to safety standards and regulations.

What's more, if necessary, stakeholders can track unsafe job sites and work practices. Correspondence that addresses these concerns can be archived. Should further training or investigation ever be necessary, Reconstruct allows stakeholders to rewind the clock to visualize poor safety conditions or near misses at any date and time when reality capture was performed.

This information can be helpful to, first and foremost, provide a safe environment to all stakeholders and, as a result, better match the required insurances to project needs.

5. Property damage

Many of the steps mentioned in the prior sections around construction also apply to completed properties. Remote stakeholders, including owners and insurers, can frequently check in on the job site, document damages by measuring their severity, and track unsafe or risky activity. Once again, all correspondence should be archived.

How Reconstruct works

In general, reality mapping can serve as its own sort of “digital risk engineer” by providing off-site stakeholders with all of the visual assets they need to determine the safety and risk present on the job site. The more frequently reality capture is performed, the more accurate and up-to-date the virtual representation of the job site.

Reconstruct allows users to blend any and all job site footage, including that taken on everyday devices such as 360 cameras, smartphones, and drones. This reality data can be blended with BIM, laser scanner footage, and more.

The return on investment for all parties is clear. Stakeholders, including insurers, walk away with as-built documentation of the project. During construction, the digital twin empowers remote quality assurance and quality control. Progress tracking and scheduled forensic analysis are also essential.

About Reconstruct

Reconstruct has set the standard for digital twins used by risk engineers and insurers to observe, inspect, and evaluate risk at job sites without the need for constant and resource-intensive travel. To see your project in Reconstruct, schedule a free demo today.

.png)

-2.png)